The Influence of Competitiveness and Regulations on Entrepreneurial Activity in Emerging and Advanced Economies

La influencia de la competitividad y las regulaciones en la actividad empresarial de economías emergentes y avanzadas

Influência da competitividade e das regulações de atividades empresariais nas economias emergentes e avançadas

DOI:

https://doi.org/10.15446/innovar.v24n1spe.47560Palabras clave:

entrepreneurship, entrepreneurial activity, competitiveness, regulation, economic activity (en)emprendimiento, actividad emprendedora, competitividad, regulación, actividad económica (es)

empreendimento, atividade empreendedora, competitividade, regulação, atividade económica (pt)

The Influence of Competitiveness and Regulations on Entrepreneurial Activity in Emerging and Advanced Economies1

La influencia de la competitividad y las regulaciones en la actividad empresarial de economías emergentes y avanzadas

L'influence de la compétitivité et des régulations sur l'activité entrepreneuriale dans les économies émergentes et avancées

Influência da competitividade e das regulações de atividades empresariais nas economias emergentes e avançadas

Mário RaposoI, Ricardo RodriguesII, Anabela DinisIII, Arminda do PaçoIIII, João J. FerreiraIIIII

I Ph. D. in Management. Department of Business and Economics and NECE-Research Unit of Business Science, University of Beira Interior (UBI). Covilhã, Portugal. E-mail: mraposo@ubi.pt

II Ph. D. in Business. Department of Business and Economics and NECE-Research Unit of Business Science, University of Beira Interior (UBI). Covilhã, Portugal. E-mail: rgrodrigues@ubi.pt

III Ph. D. in Management. Department of Business and Economics and NECE-Research Unit of Business. Covilhã, Portuga. E-mail: adinis@ubi.pt

IIII Ph. D. in Management. Department of Business and Economics and NECE-Research Unit of Business Science, University of Beira Interior (UBI). Covilhã, Portugal. E-mail: apaco@ubi.pt

IIIII Ph. D. in Management. Department of Business and Economics and NECE-Research Unit. University of Beira Interior (UBI) and NECE- Research Unit of Business Science. Covilhã, Portugal. E-mail: jjmf@ubi.pt

Correspondencia: João J. Ferreira, PhD in Management. Department of Business and Economics and NECE-Research Unit. University of Beira Interior (UBI) and NECE-Research Unit of Business Science. Pólo IV-Edifício Ernesto Cruz, 6200-209 Covilhã, Portugal. Tel: +351275319600, Fax: +351275319601.

Citación: Raposo, M., Rodrigues, R., Dinis, A., Do Paço, A., & Ferreira, J. J. (2014). The Influence of Competitiveness and Regulations on Entrepreneurial Activity in Emerging and Advanced Economies. Innovar, vol. 24, Edición Especial 2014, 113-128.

Clasificación JEL: M1, M2, L2.

Recibido: Julio de 2012, Aprobado: Enero de 2014.

Abstract:

This paper aims to investigate the link between business regulations, pillars of competitiveness, and new firms at country level using a structural equation model. The research developed to support this paper is based on the idea that entrepreneurship, measured as the process of new firm formation, is a vital link to the economic growth of countries. The data used belongs to a sample of 41 countries with emerging and advanced economies that appear simultaneously in three databases: The Global Entrepreneurship Monitor (GEM), the Global Competitiveness Report (GCR), and the Doing Business Report (DBR). At country level, the process is hindered by the competitiveness conditions of the country's phase of economic development, and by the regulation and institutional arrangements that shape economic activity.

Key words: Entrepreneurship, entrepreneurial activity, competitiveness, regulation, economic activity.

Resumen:

Este artículo tiene como objetivo investigar la relación entre las regulaciones de los negocios, pilares de competitividad, y la creación de nuevas empresas a un nivel nacional utilizando un modelo de ecuaciones estructurales. La investigación desarrollada para apoyar este trabajo se basa en la idea de que el espíritu empresarial medido como el proceso de formación de nuevas empresas es un enlace vital para el crecimiento económico de los países. Los datos utilizados corresponden a una muestra de 41 países pertenecientes a las economías emergentes y avanzadas que aparecen de manera simultánea en tres bases de datos: el Global Entrepre-neurship Monitor (GEIVI), el Informe Global de Competitividad (IGC) y el Informe Doing Business (DBR). A nivel nacional, el proceso se ve obstaculizado por las condiciones de competitividad de la fase de desarrollo económico que atraviesa el país, así como por las regulaciones y los acuerdos institucionales que dan forma la actividad económica.

Palabras clave: emprendimiento, actividad emprendedora, competitividad, regulación, actividad económica.

Résumé:

Cet article a pour objectif d'étudier la relation entre les regulations des affaires, piliers de la compétitivité, et la creation de nouvelles entreprises à un niveau national en utilisant un modèle d'equations structurelles. Cette recherche se base sur l'idee que l'esprit entrepreneurial évalué comme le processus de formation de nouvelles entreprises est un lien vital pour la croissance économique des pays. Les données utilisées correspondent à un échantillon de 41 pays qui font partie des économies émergentes et avancées qui apparaissent simultanément dans trois bases de données: le Global Entrepreneurship Monitor (GEM), le Informe Global de Competitividad (IGC) et le Informe Doing Business (DBR). Le processus dans le pays subit les influences dérivées des conditions de compétitivité de la phase de développement économique, et de la régulation et des accords institutionnels qui modèlent l'activité économique.

Mots-clés: Entrepreneuriat, activité entrepreneuriale, compétitivité, régulation, activité économique.

Resumo:

O objetivo deste artigo é pesquisar a relação entre as regulações dos negócios, pilares de competitividade, e a criação de novas empresas em nível nacional utilizando um modelo de equações estruturais. A pesquisa realizada para apoiar este trabalho se baseia na ideia que o espírito empresarial, medido como o processo de formação de novas empresas, é uma ligação vital para o crescimento económico dos países. Os dados utilizados correspondem a uma amostra de 41 países pertencentes às economias emergentes e avançadas que aparecem, simultaneamente, em três bases de dados: Global Entrepreneurship Monitor (GEM), o relatório Global de Competitividade (IGC) e o relatório Doing Business (DBR). O processo no país está sob a influência decorrente das condições de competitividade da fase de desenvolvimento económico e da regulação e os arranjos institucionais que dão forma à atividade económica.

Palavras-chave: Empreendimento, atividade empreendedora, competitividade, regulação, atividade económica.

Introduction

Since the last quarter of the 20th century, the world has experienced a radical transformation in the national determinants of competitiveness. As a result of technological advances and economic integration, the old paradigm of development has changed. In fact, Audretsch and Thurik (2001) stated that there has been a conspicuous change from a "managed economy" to an "entrepreneurial economy" as a result of globalisation, deregulation, outsourcing, and new emerging technologies such as information and communications technology (ICT) and biotechnology. Globalisation has contributed to the importance of local conditions in countries' competitiveness; it requires each country to compete based on its productivity as a business platform for a widening array of activities, and is driving rapid improvement in business environments. Many countries are aggressively pursuing best practices in terms of regulatory environment, infrastructure, university assets, and other diamond conditions (Porter, Ketels & Delgado, 2007). Furthermore, a new competitive model has emerged in which innovation, entrepreneurship, and entrepreneurial activity give the necessary dynamism to economic growth. As this new competitive model has emerged, according to Audretsch and Beckmann (2007), entrepreneurship has come to be perceived as the engine of economic and social development around the world. This is quite clear in the perspective of the European Union (EU), which recommends a new strategy to spur economic growth, create jobs, and reduce unemployment: The Lisbon Strategy committed Europe to the promotion of entrepreneurship as a cornerstone of European economic growth.

From the perspective of entrepreneurship and economic growth, the most vital concepts seem to be the incentives and rules for competition. In this sense, Wennekers and Thurik (1999) argue that the legal and institutional framework is a vital factor behind entrepreneurship and that it is essential to consider this framework for a good understanding of economic growth. Legal incentives for entre-preneurship are mainly rooted in the fiscal regime and in the laws concerning bankruptcies. Rules for competition have to do with entry regulation, antitrust policy, removal of trade barriers, transparency of the markets, and also with the power of unions in the labour market.

Another key element in increasing the competitiveness of the economy is the entrepreneurial spirit of a country's citizens. This is reflected not only in the number of existing firms but also in the dynamism with which innovative products and services are introduced into the market. High levels of both of these measures characterize developed economies (see, for instance GEM's studies).

Considering the above, we therefore assume that entre-preneurship-measured as the process of new firm formationis a vital link to the economic growth of countries. But at country level, the process is negatively influenced by competitiveness conditions, the country's phase of economic development, and the regulation, laws, and institutional arrangements that shape economic activity.

Several studies have investigated the relationship between regulations and entrepreneurship (Audretsch & Thurik, 2001; Dreher & Gassebner, 2007; Van Stel, Storey & Thurik, 2007; Wennekers & Thurik, 1999), between entrepreneur-ship and competitiveness (Porter et al., 2007), and also between economic growth and entrepreneurial activity (Audretsch & Beckmann, 2007; Audretsch & Thurik, 2001; Holcombe, 1998; Minniti, Bygrave & Autio, 2006).

This paper aims to investigate the link between business regulations, the pillars of competitiveness, and the new firms at country level in emerging and advanced economies. Therefore, the central questions of this research are the following: a) How are regulations related to or how do they influence the competitiveness of a country and its entrepreneurial activity (established firms and new firms)?; b) does competitiveness itself influence entrepreneurial activity in different economies?; and c) do established firms influence the formation of new firms?

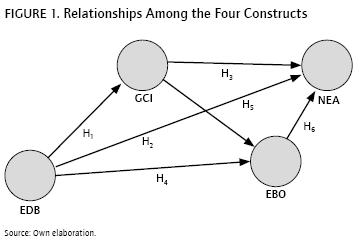

Using structural equation modelling (SEM), including Global Competitiveness Index (GCI), Ease of Doing Business (EDB) and entrepreneurial activity-considering both Established Business Owners (EBO) and Nascent Entrepreneurial Activity (NEA)-a model was developed in order to identify causal influences among these four constructs.

We tested the model using secondary empirical data related to 41 countries, obtained from three free different databases available on the Internet for the year 2008: The study of Global Entrepreneurship Monitor (GEM) developed by London Business School and Babson College; the Global Competitiveness Report (GCR) from the World Economic Forum; and the Doing Business Report from the World Bank. The research is structured so that after this introduction, we present a link between entrepreneurship and economic growth. Following that, based on a literature review, we discuss the relationship between entrepreneurial activity, competitiveness, and economic growth, as well as between entrepreneurship and regulation. In the next section, the research methodology and proposed model is presented, and after that the research results are analysed and discussed. Finally, we address the conclusions, limitations, and future lines of research.

Entrepreneurial Activity, Competitiveness, and Economic Growth

The link between entrepreneurship and economic growth has long been supported in the literature. Perhaps the most influential view is the one proposed by Schumpeter (1934, 1942), who saw the entrepreneur as someone who caused disequilibrium by introducing new technologies-what he called creative destruction. Creative destruction is presented as the dynamic process that produces economic growth. More recently, Kirzner (1973, 1997) emphasised the role of pushing the economy towards equilibrium by exploiting previously unperceived opportunities to reach the production possibility frontier. Entrepreneurs act upon these opportunities and the economy becomes more productive as it is able to produce more consumer satisfaction at a lower cost.

According to Holcombe (1998), in the latter half of the 20th century, a production function approach to economic growth introduced the idea that output could be best increased by increasing the inputs into the production process. According to this argument, the prescription for economic growth is to create an institutional environment that encourages markets and rewards entrepreneurial activity. In the same vein, Acs and Storey (2004) argue that entrepreneurship could be defined as a production factor, meaning that output is enhanced not only by increased quantities of labour, capital, and knowledge, but also by how entrepreneurship improves the allocation of these factors throughout the economy.

The emergence of the idea that entrepreneurship is the engine that stimulates economic growth, employment, and competitiveness in global markets is nowadays supported by various researchers. For instance, in the view of Wennekers and Thurik (1999), entrepreneurship matters. In modern open economies it is more important for economic growth than it has ever been, because globalisation and the ICT revolution imply a need for structural change, requiring a substantial reallocation of resources, which in turn produces an intense demand for entrepreneurship (Audretsch & Thurik, 1998).

According to Porter (1990), entrepreneurship is at the heart of national competitive advantage, and is important for carrying out innovations. Porter's work offers distinctive views of the role of the entrepreneur in explaining economic development and the growth of nations, and en-trepreneurship, considered as an innovative activity, can be attached to the diamond's determinants of competitiveness. Innovative activity is a central element shaping both the competitiveness and the economic development of nations and regions. The capacity to innovate, more evident in "high impact entrepreneurs", has been shown to serve as the engine that drives economic growth, wealth generation, and job creation (Morris, 2011). Since the 1980s, new high-technology ventures and SMEs have increasingly been recognised as important sources of such innovative activity (Soete & Stephan, 2004).

Porter (1990) defines competitiveness according to a country's economic development, distinguishing three specific stages: The factor-driven stage (where countries compete through low cost efficiencies in the production of commodities or low value-added products); the efficiency-driven stage (where countries must have efficient productive practices in large markets, which allow companies to exploit economies of scale); and the innovation-driven stage (where the countries promote innovation so they are able to reach the technological border, and thus become a knowledge-based economy). In the third stage of economic development, most developed countries have experienced a transition from a managed economy model to an entrepreneurial economy model, characterized by knowledge spillovers, increased competition, and the existence of diversity among major firms (Audretsch & Thurik, 2001). National policy regulation, government programs, infrastructure, and R&D transfers tend to be more highly rated in innovation-driven economies (Bosma, Wennekers & Amorós, 2011).

As Acs, Audretsch, Braunerhjelm and Carlsson (2003) propose, it is the entrepreneurial mechanism that turns innovation into economic output. A lack of entrepreneurship can therefore be seen as a bottleneck for innovation-driven countries in achieving their growth ambitions.

At country level, the link between entrepreneurship and growth can be found in various empirical studies. Thurik (1999), in a study of the 23 countries belonging to the Organisation for Economic Cooperation and Development (OECD), provided empirical evidence that increased entre-preneurship, measured by business ownership rates, was associated with higher rates of employment growth at country level. Also, Carree and Thurik (1999) found that the OECD countries showing higher increases in entrepre-neurship have experienced greater rates of growth and lower levels of unemployment.

In the study developed by Audretsch and Thurik (2002) for the OECD, the authors undertook two separate empirical analyses to identify the impact of changes in entrepreneur-ship on growth. Each analysis used a different measure of entrepreneurship, sample of countries, and specification. One used a database that measured entrepreneurship in terms of economic activity registered by small firms. It linked changes in entrepreneurship to growth rates for a panel of 18 OECD countries, spanning five years, to test the hypothesis that higher rates of entrepreneurship lead to greater growth rates. The other analysis used a measure of self-employment as an index of entrepreneurship and linked changes in entrepreneurship to unemployment in the country between 1974 and 1998. The different samples, including OECD countries over different time periods, reached consistent results, namely that increases in entrepreneurial activity tend to result in higher subsequent growth rates and in reduced unemployment.

Audretsch (2002) argued that countries exhibiting a greater increase in entrepreneurship rates also tended to exhibit greater decreases in unemployment rates. This would suggest a negative relationship between entrepreneurial activity and subsequent unemployment. According to the author, a similar relationship between entrepreneurship and growth rates, for a broader spectrum of countries, was shown by the GEM study. This study established an empirical link between the degree of entrepreneurial activity and economic growth, measured by employment, at the country level (Reynolds, Hay, Bygrave, Camp & Autio, 2000).

Acs, Arrenius, Hay and Minniti (2005) stated that several studies, as well as the 2004 GEM Global Reports, have shown the existence of a systematic relationship between the per capita GDP of a country, its economic growth, and its level and type of entrepreneurial activity. Countries with similar per capita GDP tend to exhibit similar levels of entrepreneurial activity, while significant differences exist across countries with different per capita GDP levels. Consistent evidence emerges from the analysis of GEM 2005 (Minniti et al., 2006).

Some authors (Beugelsdijk, 2007; Uhlaner & Thurik, 2007) have stated that if there are more people with entrepreneurial values in a country, there will be more people displaying entrepreneurial behaviour. Uhlaner and Thurik (2007) found a positive correlation between established businesses and nascent entrepreneurs.

Furthermore, Wright, Robbie and Ennew (1997) stated that entrepreneurial activity may not simply involve the creation of a single venture; usually an entrepreneur becomes involved in a certain number of businesses. Gries and Naudé (2009) asserted that growth in the regional economy is driven by an expansion in the number of startup firms supplying intermediate goods and services.

Entrepreneurship and Regulations

Nowadays governments are very committed to the economic development of their countries, and to giving their citizens more opportunities to create firms. Consequently they are focused on more than purely macroeconomic conditions. They are paying increasing attention to the laws, regulations, education, and institutional arrangements that shape daily economic activity.

Political and economic institutions underlie and determine the incentive structure in a society. Hence, they have an important effect on society's economic performance (North, 1991, 1994). The institutional environment includes formal rules such as constitutions, regular law, and regulations (North, 1991), defining and enforcing property rights and contract laws, which are of course rudimentary for economic activities and transactions. Secure property rights ensure that people are able to keep the returns of their entrepreneurial activities.

In a paper developed by Klapper, Laeven and Rajan (2006) using cross-country data from the Amadeus database, the authors tried to identify the impact of business environment on entrepreneurship. The data used allowed them to construct entry rates across sectors, and test the effect of diverse industry and country level conditions on new firm creation. The results of the research suggest that entry regulations have significant adverse effects on the entry rate of firms.

Dreher and Gassebner (2007) tested whether regulations robustly discourage firms from entering markets. The research used data provided by the GEM with a focus on nascent entrepreneurial activity (defined as the percentage of the adult population who are nascent entrepreneurs) and data about the regulations of starting a business. The empirical analysis also included four other variables taken from the Doing Business Data set provided by the World Bank: The number of procedures required to start a new business; the number of days required to start a new business; the costs of starting a new business; and the minimum capital required to start a new business. The results showed that some regulations do indeed matter for en-trepreneurship. Specifically, it was found that when more procedures are required to start a business and minimal capital requirements are greater, this is-on average-detrimental to entrepreneurship. Clearly, the impact of regulations on entrepreneurial activity is likely to depend on the quality of a country's regulatory institutions.

Van Stel et al. (2007) state that entrepreneurship policy makers who are seeking to increase rates of new firm formation and subsequent wealth formation are faced with two main choices: To follow a low regulation route or a high support route. The first option will probably enable businesses to start as quickly and cheaply as possible. The second could minimise the number and stringency of regulations for businesses while they are trading. In their study, involving data from 39 countries, Van Stel et al. tried to find a relationship between regulation and entrepreneur-ship, and arrived at three main conclusions. First, contrary to other studies, they found no significant impact of administrative considerations such as time, cost, or the number of procedures to start a business on nascent or young business formation. Second, they found differences between the determinants of opportunity and necessity entrepre-neurship. While opportunity entrepreneurship is influenced by higher education, necessity entrepreneurship is not. Third, they found that it is the labour market, rather than entry regulations, which exerts a strong influence upon the nascent and young business rate.

Given the above, is still not clear if, or how, regulations affect entrepreneurial activity.

Methodology and Proposed Model

Data on Entrepreneurial Activity, Competitiveness, and Regulations

The present research intends to develop the analysis at a country level, using a sample of countries. Given the difficulty of obtaining primary data, it was decided to use secondary data, available from three different databases and with different foci of entrepreneurship rates, competive-ness, and regulations. The data used belongs to a sample of 41 countries (see Appendix A) that appear simultaneously in three databases: The study of Global Entrepreneur-ship Monitor (GEM) developed by London Business School and Babson College, the Global Competitiveness Report (GCR) from the World Economic Forum, and the Doing Business Report from the World Bank, using the 2008 year as a reference.

Entrepreneurship data was extracted from GEM. This data set contains survey-based annual data on early-stage entrepreneurial activity for a group of countries from 2001 onwards. The surveys in the different countries are generally conducted by local university institutes. Representative samples of at least 2,000 individuals are selected annually for each country. The detailed list of partner institutions and the number of people interviewed, as well as more details on these interviews, is available in Minniti et al. (2006). We focused on entrepreneurial activity, Nascent Entrepreneurial Activity2 (NEA), and New Business Owners (NBO)3. We also used the data about established firms, Established Business Owners (EBO).

The data about regulations was taken from the World Bank Doing Business (WBDB) database. According to the WBDB (The International Bank For Reconstruction And Development / The World Bank, 2008: iii) database: "Doing Business provides a quantitative measure of regulations for: starting a business, dealing with the construction permits, employing workers, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts and closing a business" as they apply to domestic small and medium-size enterprises. The Doing Business indicators are comparable across 155 countries. For our research we extracted the data about the same 41 countries. This variable was called Ease of Doing Business (EDB) (see Appendix B).

With respect to business competitiveness, data was gath -ered from the Global Competitiveness Report 2008-2009 (Schwab & Porter, 2008, p. 3). In this study "competitiveness is defined as the set of institutions, policies, and factors that determine the level of productivity of a country". The concept of competitiveness involves static and dynamic components, and its determinants are many and complex. The Global Competitiveness Index (GCI) provides a weighted average of many different components, each of which reflects one aspect of the complex reality called competitiveness. This index grouped the components of competitiveness into 12 pillars: Institutions, infrastructure, macroeconomic stability, health and primary education, higher education and training, goods market efficiency, labour market efficiency, financial market sophistication, technological readiness, market size, business sophistication, and innovation. The GCI ranks 127 countries. For our research we extracted the data corresponding to the 12 pillars of competitiveness, using the same sample of 41 countries belonging to the GEM and Doing Business databases.

Proposed Model and Research Hypotheses

The model above considers a group of variables likely to influence Nascent Entrepreneurial Activity (NEA). It is composed of various constructs, each one measured by its respective indicators (see Appendix B). The NEA construct includes two indicators; the Ease of Doing Business (EBO) construct is measured with one indicator; the Global Competitiveness Index (GCI) construct is composed of three indicators; and finally the Established Business Owners (EDB) construct is composed of 10 sub-indicators.

As shown in Figure 1, EBO and GCI will, together, contribute to NEA. There is also a connection between the EDB and GCI constructs, and between EDB and EBO.

In order to test the model presented above, a set of research hypotheses were formulated:

H1: Ease of Doing Business positively influences Global

Competitiveness

[EDB GCI]

H2: Ease of Doing Business positively influences Entrepreneurial Activity [EDB→NEA]

H3: Global Competitiveness positively influences Entrepreneurial Activity [GCI→NEA]

H4: Ease of Doing Business positively influences Established Business Owners [EDB→EBO]

H5: Global Competitiveness positively influences Established Business Owners [GCI→EBO]

H6: Established Business Owners positively influences Entrepreneurial Activity [EBO→NEA]

Methods

The items connected with Global Competitiveness (GCI), Nascent Entrepreneurial Activity (NEA), Establish Owners (EBO) and Ease of Doing Business (EDB) constructs were collected and compiled in a unique file. We studied the reliability of the indicators (manifest variables) and latent variables (constructs), as well as their validity. Individual indicator reliability is assessed by the loadings or the correlations between the indicator and the construct; to assess construct (latent variable) reliability we evaluated the possible presence of multicollinearity problems.

Data was analysed using structural modelling equations, through the statistical software PASW 18.0. The Partial Least Squares (PLS) technique was also used to test the model, making use of the SmartPLS 2.0.M3 software (Ringle, Wende & Will, 2005).

The PLS method is a technique of statistical modelling through structural equations that allows the simultaneous estimation of a group of equations by measuring the concepts (measurement model) and the relationships between them (structural model), and it has the capacity to address concepts that are not directly observable (Paço, Ferreira, Raposo, Rodrigues & Dinis, 2011; Rodrigues, Raposo, Ferreira & Paço, 2010; Rodrigues & Raposo, 2011).

The R2 measure is used to evaluate the inner model, the Stone-Geisser test (Geisser, 1974; Stone, 1974) to assess predictive validity of the exogenous constructs, and the structural relationship significance is appraised by deploying jack-knife and bootstrap techniques (Chin, 1998). During the estimation process, PLS maximises explained variance for the indicators and latent variables, making it possible to examine the relationships and the R-Squared (R2) facets. A series of iterative factorial analyses is performed through the OLS (Ordinary Least Squares) estimation technique, combining linear multiple regression and path analyses. The estimation of parameters focuses on minimisation of the residual variance of all the latent model variables.

Table 1 shows the main methodological aspects related to the investigation.

Results and Discussion

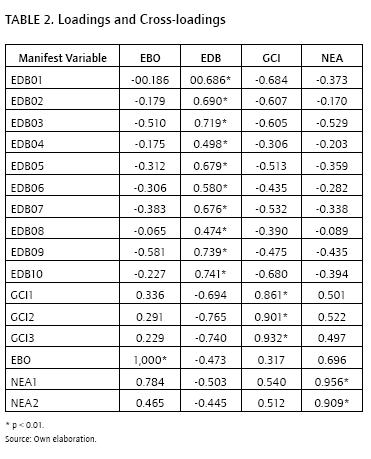

To define a reliable individual indicator, the loadings or the correlations between the indicator and the construct should be significant (p < 0.05). In addition, the cross-loadings of each indicator (correlations between indicators and other constructs) should be much smaller than the loading of that indicator (Gefen & Straub, 2005). The loadings and cross-loadings are presented in Table 2, which shows that all loadings were significant (p < 0.01) and all cross-loadings were smaller than the loadings on the item's own factor.

According to Duarte and Raposo (2010), formative indicator assessment includes multicollinearity analysis of the manifest variables (indicators). When analysing constructs with formative indicators, the examination should focus on the weight of each indicator to form the construct.

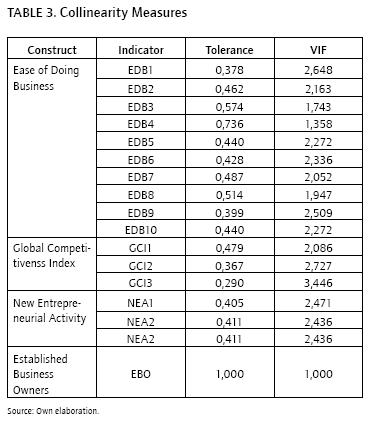

According to Chin (1998), the loading analysis may be misleading, since the correlations among the indicators in the same construct are not considered in the estimation process. Thus, the analysis should consider the weight of indicators in PLS output and respective significance statistics, found by means of a bootstrap process (Chin, 1998). To evaluate multicollinearity, an evaluation of both the tolerance value and the VIF (Variance Inflation Factor) is performed. These measures give us the degree to which each independent variable is explained by the others (Hair, Black, Babin & Anderson, 2010). Table 3 shows these statistics. The indicators have no multicollinearity problems, as there are no tolerance values close to zero and VIF values are close to one4. To evaluate the structural model, the two criteria used are the explanatory power of the model (R2), and the value and significance of the path coefficients (Duarte & Raposo, 2010).

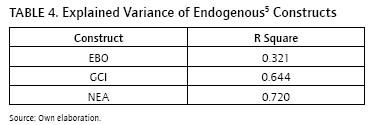

According to Table 4, explained variance is low for the Established Business Owners (EBO) construct. Although consistent with the results of similar models (e.g. Raposo, Ferreira, Paço & Rodrigues, 2008), the variance of EBO explained by Ease of Doing Business (EDB) is below 0.5. This provides evidence that EBO depends more on other factors than on EDB. According to Liñán and Chen (2009), this kind of statistical result is convergent with most previous research using linear models.

Table 5 shows the correlation matrix for the model's constructs. It can be seen that the correlations are high, with the exception of that between Global Competitiveness Index (GCI) and EBO. Additionally, only two bivariate correlations (out of six) have a positive sign. EBO is negatively correlated to EDB and GCI, and Nascent Entrepreneurial Activity (NEA) is negatively correlated to EDB and GCI.

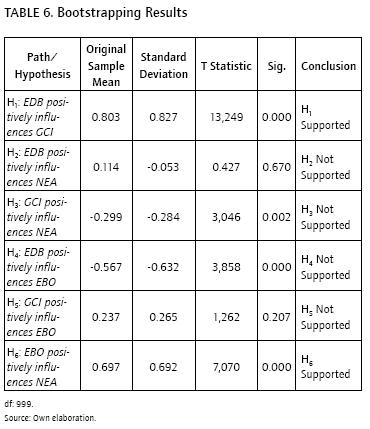

Finally, to test the significance of the path coefficients, we used the bootstrapping technique. This consists of generating a large number of sub-samples from the original sample through the systematic deletion of observations (Dinis, Paço, Ferreira, Raposo & Rodrigues, 2013), with 1,000 samples of 40 cases each. The results presented in Table 6 show that two relationships are significant. They are also above 0.20 in absolute value, the threshold value for being considered robust (Chin, 1998).

The path coefficients set out in Table 6 are the estimated direct effects, which are also shown in the final model (Figure 2). Direct effects measure the direct impact of one construct over another, and they are interpreted as regression coefficients.

Direct effects, when summed with indirect effects6, result in the total effects, shown in Table 7.

The graphical description of the relationships among the constructs offered in Figure 2 illustrates the results shown previously. As can be seen in Table 6, the final model supports only two hypotheses: H1 and H6 The other hypotheses are not supported.

As the results seem somewhat surprising, we next tried to obtain more evidence to explain the results obtained. Thus, we compared all countries involved in the study, to observe their relationship with the different constructs.

Figure 3 shows the relationship between GCI and EDB. As shown in the figure, countries with higher levels of competitiveness are the countries with better EDB. Nevertheless, there are countries ranking higher than median competitiveness with lower EDB, such as India, Chile, and even Spain. Furthermore, Romania, while ranking low on competitiveness, ranks relatively highly on EDB.

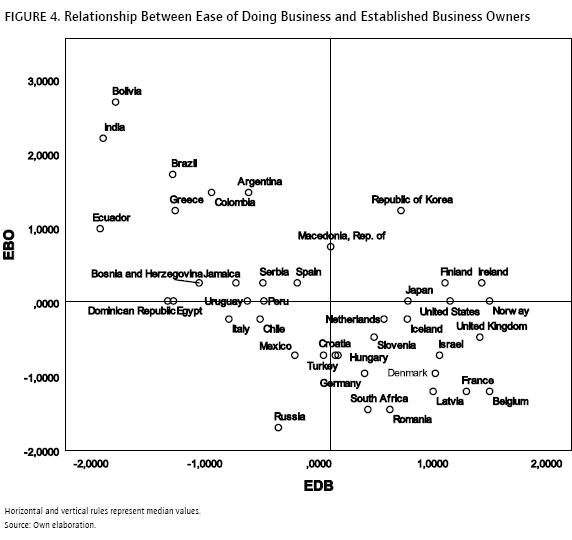

Figure 4 shows the relationship between EBO and EDB, and clearly reveals differences between countries. There are countries where doing business is difficult, but which have a very high level of EBO, like some emerging countries such as Bolivia, Ecuador, Argentina, India, Brazil, and others.

On the other hand, countries such as Belgium, France and the United Kingdom have high EDB levels but lower EBO rankings. Clearly there are differences between countries with different levels of development.

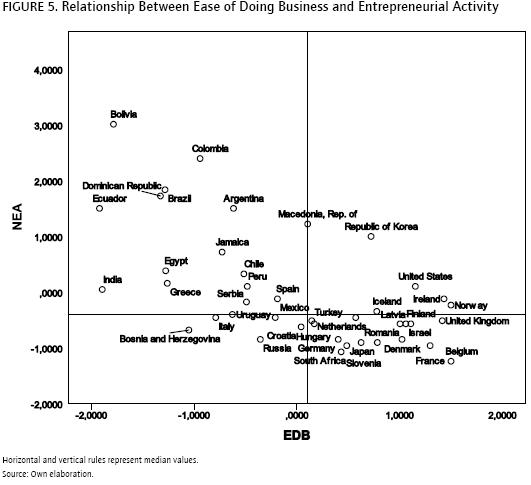

Figure 5 shows the relationship between EDB and NEA. The picture is quite similar to what is shown in Figure 4, revealing differences between countries with different levels of development. Latin American countries such as Bolivia, Colombia, Ecuador, the Dominican Republic, and Brazil have high NEA rates, but EDB is low. Meanwhile, countries such as the United Kingdom, France, Denmark, Japan, Belgium, and Germany have low NEA rates but higher EDB.

The relationship between GCI and NEA is shown in Figure 6. Highly competitive countries, such as Finland, France, and Germany show low NEA when compared to others.

The opposite quadrant, with higher NEA and low GCI, contains most of the Latin American countries such as Bolivia, Colombia and Brazil, and also the Republic of Macedonia.

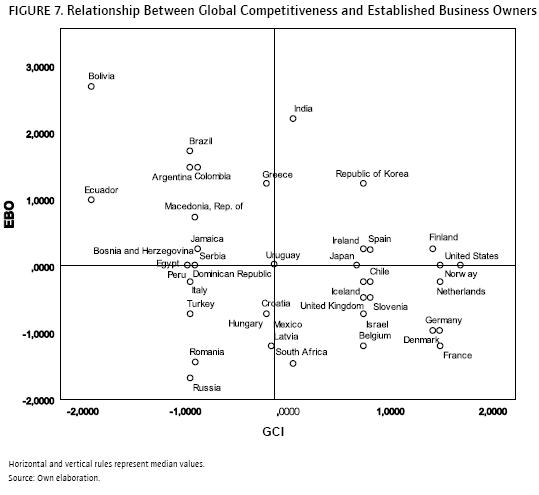

Figure 7 shows the relationship between GCI and EBO. This graph shows a great dispersion, with countries in all quadrants.

Indeed there are countries low on GCI and high on EBO, such as Bolivia and Ecuador, while others have high GCI and high EBO, such as Finland and the Republic of Korea. Meanwhile, countries such as France, Germany, and Denmark have high CGI and low EBO, and others have low GCI and low EBO, such as Russia, Romania, and Turkey.

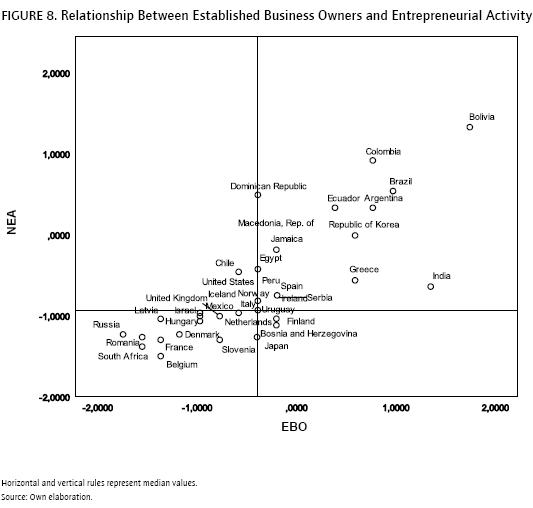

The relationship between EBO and NEA is shown in Figure 8. In this figure we see that Latin American countries such as Bolivia, Colombia, Brazil, Ecuador, and Argentina have higher levels of EBO and higher levels of NEA. More developed countries, such as France, Belgium, Denmark, and the Netherlands have lowers levels of EBO and NEA. Others like the United States, Norway, and the United Kingdom are around the median values.

Conclusions

In this paper, we have sought to investigate whether competitiveness and regulations affect entrepreneurial activity through an analysis at country level. The study was based on secondary data obtained from a sample of countries studied in three different data sources: Global Entrepre-neurship Monitoring, Global Competitiveness Report, and Doing Business Report. Four constructs were developed and their interconnections were studied through six research hypotheses. After carrying out a structural equations model analysis, we concluded that only two hypotheses were supported: Ease of Doing Business (EDB) positively influences the Global Competitiveness Index (GCI), and Established Business Owners (EBO) positively affects Nascent Entrepreneurial Activity (NEA).

Surprisingly, the relationship between GCI and NEA, as well as that between GCI and EBO, were not supported.

Since our findings are not supported by the literature review that analyses the relationship between competiveness and entrepreneurial activity, we tried to find explanations for these results, developing a new analysis by undertaking a graphical comparison of the countries involved, based on the relationship between the constructs. This gave us the idea that there are large differences between developed countries and less developed countries, and when we analyse them together, the results appear to be disconnected from the relevant literature. In future research this aspect must be taken into consideration.

Considering the relationship between different variables, it is possible to see different patterns in the countries analysed. Latin American countries show a higher level of entrepreneurial activity that contrasts with the difficulty of doing business and shows low global competitiveness compared to other countries.

The results indicate that EDB has a negative impact both on NEA and EBO. The explanation and the search for the reasons behind these findings constitute the main challenge of the paper. In the literature review, the paper of Van Stel et al. (2007), also concluded that the higher influence on entrepreneurship is not related to entry regulations-it is the labour market and education that exert a strong influence on entrepreneurial activity. Cultural aspects that are not included in our model could also have an influence on this construct.

Entrepreneurship has been observed to be an important factor for growth at the firm and country level. But according to Valliere (2010), mechanisms for this effect are still weakly understood. For instance, entrepreneurship seems to play a relevant role in converting national knowledge capital into economic benefit, but this effect can depend on the per capita GDP of each nation. His research provides some advances in this area by supporting the theoretical position that entrepreneurial activity promotes economic growth independently of growth arising from established firms. Additionally, Van Stel et al. (2007) also conclude that the level of entrepreneurial activity in a country is affected by a broad number of contextual and environmental factors.

As stated earlier, there is a gap in the literature in this area, i.e., existing studies have conducted a more specific analysis focused on particular aspects. Some authors (e.g. Audretsch, 2002; Audretsch & Thurik, 2002; Carree & Thurik, 1999; Thurik, 1999) have attested to the linkage between en-trepreneurship activity and employment at country level, while others have demonstrated the relationship between per capita GDP and entrepreneurial activity (e.g. Acs et al., 2005). However, our findings are in accordance with some results of Van Stel et al. (2007). These authors concluded that some dimensions of the EDB were not significant in influencing entrepreneurship.

Our recommendations follow those of Nasra and Dacin (2010), which state that the government can influence entrepreneurial behaviour by identifying opportunities and by acting as an institutional entrepreneur. To do this, it is necessary to adapt regulations and processes in order to maximize the development of those opportunities, eliminating obstacles to entrepreneurship activity and offering incentives for investment.

Our results have important implications for examining institutional and environmental conditions useful for public policy planning in terms of a general perspective of competitiveness and regulation in entrepreneurial activity at country level. We hope to provide more information to highlight how imperative it is to create competitive new ventures in those countries.

Pie de página

1Acknowledgments: The authors acknowledge the financial support given by the Portuguese Foundation for Science and Technology, Ministry of Science, Technology and Higher Education.

2Percentage of the population aged 18-64 who are currently a nascent entrepreneur, i.e., actively involved in setting up a business they will own or co-own; this business has not paid salaries, wages, or any other payments to the owners for more than three months.

3Percentage of the population aged 18-64 who are currently a owner-manager of a new business, i.e., owning and managing a running business that has paid salaries, wages, or any other payments to the owners for more than three months, but not more than 42 months.

4VIF = 1 indicates the absence of multicollinearity among variables. VIF values higher than 10 point to the presence of multicollinearity.

5An endogenous construct is conceptually similar to a dependent variable in regression analysis.

6The indirect effect of EDB over NEA is the product of the direct effect EDB→EBO with the direct effect EBO→NEA summed with the product of EDB→CGI with GCI→NEA (-0.567x0.697+0.80 3x-0.299=-0.6353).

References

Acs, Z. J., Arrenius, P., Hay, M., & Minniti, M. (2005). 2004 Global Entrepreneurship Monitor. London U.K, and Babson Park, MA: London Business School and Babson College.

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2003). The missing link: The knowledge filter and endogenous growth. Stockholm, Sweden: Center for Business and Policy Studies.

Acs, Z. J., & Storey D. (2004). Introduction: Entrepreneurship and economic development. Regional Studies, 38(8), 871-877.

Audretsch, D. B. (2002). Entrepreneurship: A survey of the literature, prepared for the European Comission, Institute for Development Strategies, Indiana University & Centre for Economic Policy Research (CEPR), London.

Audretsch, D. B., & Beckmann, I. (2007). From small business to entrepreneurship policy. In D. B. Audretsch, I. Grilo & R. Thurik (Eds.), Handbook of Entrepreneurship Policy (pp. 36-53). Edward Elgar Publishing.

Audretsch, D. B., & Thurik, R. (1998). The knowledge society, entrepreneurship and unemployment. Research Report 9801/E, Zoeter-meer: EIM.

Audretsch, D. B., & Thurik, R. (2001). What's new about the new economy? Sources of growth in the managed and entrepreneurial economies. Industrial and Corporate Change, 10, 267-315.

Audretsch, D. B., & Thurik, R. (2002). Linking entrepreneurship to growth (Working Paper, 2081/2). OECD STI.

Beugelsdijk, S. (2007). Entrepreneurial culture, regional innovativeness and economic growth. Journal of Evolutionary Economics, 17(2), 187-210. doi:10.1007/s00191-006-0048-y.

Bosma, N., Wennekers, S., & Amorós, J.E. (2011). GEM 2011 Extended Report: Entrepreneurs and Entrepreneurial Employees Across the Globe.

Carree, M., & Thurik, R. (1999). Industrial structure and economic growth. In D. B. Audretsch & R. Thurik (Eds.), Innovation, industry evolution and employment (pp. 86-110). Cambridge: Cambridge University Press.

Chin, W. (1998). The partial least squares approach to structural equation modelling'. In G. A. Marcoulides (Ed.), Modern methods for business research (pp. 295-336). New Jersey: Laurence Erlbaum Associates.

Dinis, A., Paço, A., Ferreira, J., Raposo, M., & Rodrigues, R. G. (2013). Psychological characteristics and entrepreneurial intentions among secondary students. Education + Training, 55(8/9), 1-23.

Dreher, A., & Gassebner, M. (2007). Greasing the wheels of entrepreneurship? The impact of regulations and corruption on firm entry (Working Paper, 2013). CESifo.

Duarte, P., & Raposo, M. L. (2010). A PLS model to study brand preference: An application to the mobile phone market. In V. Esposito Vinzi, W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of Partial Least Squares: Concepts, Methods and Applications (1st., pp. 449-487). Texas: Springer.

Gefen, D., & Straub, D. (2005). A practical guide to factorial validity using PLS-Graph: Tutorial and annotated example. Communications of the Association for Information Systems 16, 91-109.

Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61(1), 101-107. doi: 10.1093/biomet/61.1.101.

Gries, T., & Naudé, W. (2009). Entrepreneurship and regional economic growth: Towards a general theory of start-ups. Innovation: The European Journal of Social Science Research, 22(3), 309-328. doi:10.1080/13511610903354877.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7 ed.). Upper Saddle River: Prentice Hall.

Holcombe, R. G. (1998). Entrepreneurship and economic growth. The Quarterly Journal of Austrian Economics, 1(2), 45-62.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University Chicago Press.

Kirzner, I. M. (1997). Entrepreneurial discovery and the competitive market process: An Austrian approach. Journal of Economic Literature, 35(1), 60-85.

Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82, 591-629.

Liñán, F., & Chen, Y. (2009). Development and cross-cultural application of a specific instrument to measure entrepreneurial intentions. Entrepreneurship Theory and Practice, 33(3), 593-617.

Minniti, M., Bygrave, W. D., & Autio, E. (2006). 2005 Global Entrepreneurship Monitor. London U.K, and Babson Park, MA: London Business School and Babson College.

Morris, R. (2011). GEM 2011 High Impact Entrepreneurship Report, Center for High-Impact Entrepreneurship at Endeavor.

Nasra, R., & Dacin, M. T. (2010). Institutional arrangements and international entrepreneurship: The state as institutional entrepreneur. Entrepreneurship Theory & Practice, May, 583-609. doi: 10.1111/j.1540-6520.2009.00354.

North, D. (1991). Institutions. Journal of Economic Perspectives, 5(1), 97-112.

North, D. (1994). Economic performance through time. American Economic Review, 84(3), 359-68.

Paço, A., Ferreira, J., Raposo, M., Rodrigues, R. G., & Dinis, A. (2011). Entrepreneurial intention among secondary students: Findings from Portugal. International Journal of Entrepreneurship and Small Business, 13(1), 92-106. doi:10.1504/IJESB.2011.040418.

Porter, M. (1990). The competitive advantage of nations. New York: Free Press.

Porter, M., Ketels, C., & Delgado, M. (2007). The microeconomic foundations of prosperity: Findings from the Business Competitiveness Index, The Global Competitiveness Report 2007-2008, World Economic Forum (pp. 51-75).

Raposo, M., Ferreira, J., Paço, A., & Rodrigues, R. G. (2008). Propensity to firm creation: Empirical research using structural equations. International Entrepreneurship Management Journal, 4(4), 485-504.

Reynolds, P. D., Hay, M., Bygrave, W. D., Camp, S., & Autio, E. (2000). Global Entrepreneurship Monitor: 2000 Executive Report. Kaufman Centre for Entrepreneurial Leadership at the Ewing Marion Kaufman Foundation.

Ringle, C. M., Wende, S., & Will, A. (2005). SmartPLS. Hamburg: University of Hamburg. Retrieved from http://www.smartpls.de.

Rodrigues, R. G., & Raposo, M. (2011). Entrepreneurial orientation, human resources information management, and firm performance in SMEs. Canadian Journal of Administrative Sciences / Revue Canadienne des Sciences de Administration, 28(2), 143-153. doi:10.1002/cjas.205.

Rodrigues, R., Raposo, M., Ferreira, J., & Paço, A. (2010). Entrepreneur-ship education and the propensity for business creation: Testing a structural model. International Journal of Entrepreneurship and Small Business, 9(1), 58-73.

Schwab, K., & Porter, M. E. (2008). The Global Competitiveness Report 2008-2009. Forum American Bar Association. Geneva, Switzerland: World Economic Forum.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge. MA: Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York: George Allen & Unwin.

Soete, B., & Stephan, A. (2004). Introduction: Entrepreneurship, innovation and growth. Industry and Innovation, 11 (3), 161-165.

Stone, M. (1974). Cross-validation and multinomial prediction. Biometrika, 61(3), 509-515. doi: 10.1093/biomet/61.3.509.

The International Bank for Reconstruction and Development / The World Bank. (2008). Doing Business 2009. The International Bank for Reconstruction and Development / The World Bank. Washington, DC: World Bank, the International Finance Corporation, and Palgrave Macmillan. doi: 10.1596/978-0-8213-7609-6.

Thurik, R. (1999). Entrepreneurship, industrial transformation, and growth. In G. D. Liebcap (Ed.), The sources of entrepreneurial activity (pp. 29-66). Stamford: JAI Press.

Uhlaner, L., & Thurik, R. (2007). Postmaterialism influencing total entrepreneurial activity across nations. Journal of Evolutionary Economics, 17(2), 161-185. doi:10.1007/s00191-006-0046-0.

Valliere, D. (2010). Reconceptualising entrepreneurial framework conditions. International Entrepreneurship Management Journal, 6, 97112. DOI 10.1007/s11365-008-0077-0.

Van Stel, Storey, D., & Thurik, R. (2007). The effect of business regulations on Nascent and Young Business Entrepreneurship. Small Business Economics, 28, 171-186.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13(1), 27-56.

Wright, M., Robbie, K., & Ennew, C. (1997). Venture capitalists and serial entrepreneurs. Journal of Business Venturing, 12(3), 227-249. doi:10.1016/S0883-9026(96)06115-0.

Referencias

Acs, Z. J., Arrenius, P., Hay, M., & Minniti, M. (2005). 2004 Global Entrepreneurship Monitor. London U.K, and Babson Park, MA: London Business School and Babson College.

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2003). The missing link: The knowledge filter and endogenous growth. Stockholm, Sweden: Center for Business and Policy Studies.

Acs, Z. J., & Storey D. (2004). Introduction: Entrepreneurship and economic development. Regional Studies, 38(8), 871-877.

Audretsch, D. B. (2002). Entrepreneurship: A survey of the literature, prepared for the European Comission, Institute for Development Strategies, Indiana University & Centre for Economic Policy Research (CEPR), London.

Audretsch, D. B., & Beckmann, I. (2007). From small business to entrepreneurship policy. In D. B. Audretsch, I. Grilo & R. Thurik (Eds.), Handbook of Entrepreneurship Policy (pp. 36-53). Edward Elgar Publishing.

Audretsch, D. B., & Thurik, R. (1998). The knowledge society, entrepreneurship and unemployment. Research Report 9801/E, Zoeter-meer: EIM.

Audretsch, D. B., & Thurik, R. (2001). What's new about the new economy? Sources of growth in the managed and entrepreneurial economies. Industrial and Corporate Change, 10, 267-315.

Audretsch, D. B., & Thurik, R. (2002). Linking entrepreneurship to growth (Working Paper, 2081/2). OECD STI.

Beugelsdijk, S. (2007). Entrepreneurial culture, regional innovativeness and economic growth. Journal of Evolutionary Economics, 17(2), 187-210. doi:10.1007/s00191-006-0048-y.

Bosma, N., Wennekers, S., & Amorós, J.E. (2011). GEM 2011 Extended Report: Entrepreneurs and Entrepreneurial Employees Across the Globe.

Carree, M., & Thurik, R. (1999). Industrial structure and economic growth. In D. B. Audretsch & R. Thurik (Eds.), Innovation, industry evolution and employment (pp. 86-110). Cambridge: Cambridge University Press.

Chin, W. (1998). The partial least squares approach to structural equation modelling'. In G. A. Marcoulides (Ed.), Modern methods for business research (pp. 295-336). New Jersey: Laurence Erlbaum Associates.

Dinis, A., Paço, A., Ferreira, J., Raposo, M., & Rodrigues, R. G. (2013). Psychological characteristics and entrepreneurial intentions among secondary students. Education + Training, 55(8/9), 1-23.

Dreher, A., & Gassebner, M. (2007). Greasing the wheels of entrepreneurship? The impact of regulations and corruption on firm entry (Working Paper, 2013). CESifo.

Duarte, P., & Raposo, M. L. (2010). A PLS model to study brand preference: An application to the mobile phone market. In V. Esposito Vinzi, W. Chin, J. Henseler, & H. Wang (Eds.), Handbook of Partial Least Squares: Concepts, Methods and Applications (1st., pp. 449-487). Texas: Springer.

Gefen, D., & Straub, D. (2005). A practical guide to factorial validity using PLS-Graph: Tutorial and annotated example. Communications of the Association for Information Systems 16, 91-109.

Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61(1), 101-107. doi: 10.1093/biomet/61.1.101.

Gries, T., & Naudé, W. (2009). Entrepreneurship and regional economic growth: Towards a general theory of start-ups. Innovation: The European Journal of Social Science Research, 22(3), 309-328. doi:10.1080/13511610903354877.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7 ed.). Upper Saddle River: Prentice Hall.

Holcombe, R. G. (1998). Entrepreneurship and economic growth. The Quarterly Journal of Austrian Economics, 1(2), 45-62.

Kirzner, I. M. (1973). Competition and entrepreneurship. Chicago: University Chicago Press.

Kirzner, I. M. (1997). Entrepreneurial discovery and the competitive market process: An Austrian approach. Journal of Economic Literature, 35(1), 60-85.

Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82, 591-629.

Liñán, F., & Chen, Y. (2009). Development and cross-cultural application of a specific instrument to measure entrepreneurial intentions. Entrepreneurship Theory and Practice, 33(3), 593-617.

Minniti, M., Bygrave, W. D., & Autio, E. (2006). 2005 Global Entrepreneurship Monitor. London U.K, and Babson Park, MA: London Business School and Babson College.

Morris, R. (2011). GEM 2011 High Impact Entrepreneurship Report, Center for High-Impact Entrepreneurship at Endeavor.

Nasra, R., & Dacin, M. T. (2010). Institutional arrangements and international entrepreneurship: The state as institutional entrepreneur. Entrepreneurship Theory & Practice, May, 583-609. doi: 10.1111/j.1540-6520.2009.00354.

North, D. (1991). Institutions. Journal of Economic Perspectives, 5(1), 97-112.

North, D. (1994). Economic performance through time. American Economic Review, 84(3), 359-68.

Paço, A., Ferreira, J., Raposo, M., Rodrigues, R. G., & Dinis, A. (2011). Entrepreneurial intention among secondary students: Findings from Portugal. International Journal of Entrepreneurship and Small Business, 13(1), 92-106. doi:10.1504/IJESB.2011.040418.

Porter, M. (1990). The competitive advantage of nations. New York: Free Press.

Porter, M., Ketels, C., & Delgado, M. (2007). The microeconomic foundations of prosperity: Findings from the Business Competitiveness Index, The Global Competitiveness Report 2007-2008, World Economic Forum (pp. 51-75).

Raposo, M., Ferreira, J., Paço, A., & Rodrigues, R. G. (2008). Propensity to firm creation: Empirical research using structural equations. International Entrepreneurship Management Journal, 4(4), 485-504.

Reynolds, P. D., Hay, M., Bygrave, W. D., Camp, S., & Autio, E. (2000). Global Entrepreneurship Monitor: 2000 Executive Report. Kaufman Centre for Entrepreneurial Leadership at the Ewing Marion Kaufman Foundation.

Ringle, C. M., Wende, S., & Will, A. (2005). SmartPLS. Hamburg: University of Hamburg. Retrieved from http://www.smartpls.de.

Rodrigues, R. G., & Raposo, M. (2011). Entrepreneurial orientation, human resources information management, and firm performance in SMEs. Canadian Journal of Administrative Sciences / Revue Canadienne des Sciences de Administration, 28(2), 143-153. doi:10.1002/cjas.205.

Rodrigues, R., Raposo, M., Ferreira, J., & Paço, A. (2010). Entrepreneur-ship education and the propensity for business creation: Testing a structural model. International Journal of Entrepreneurship and Small Business, 9(1), 58-73.

Schwab, K., & Porter, M. E. (2008). The Global Competitiveness Report 2008-2009. Forum American Bar Association. Geneva, Switzerland: World Economic Forum.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge. MA: Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York: George Allen & Unwin.

Soete, B., & Stephan, A. (2004). Introduction: Entrepreneurship, innovation and growth. Industry and Innovation, 11 (3), 161-165.

Stone, M. (1974). Cross-validation and multinomial prediction. Biometrika, 61(3), 509-515. doi: 10.1093/biomet/61.3.509.

The International Bank for Reconstruction and Development / The World Bank. (2008). Doing Business 2009. The International Bank for Reconstruction and Development / The World Bank. Washington, DC: World Bank, the International Finance Corporation, and Palgrave Macmillan. doi: 10.1596/978-0-8213-7609-6.

Thurik, R. (1999). Entrepreneurship, industrial transformation, and growth. In G. D. Liebcap (Ed.), The sources of entrepreneurial activity (pp. 29-66). Stamford: JAI Press.

Uhlaner, L., & Thurik, R. (2007). Postmaterialism influencing total entrepreneurial activity across nations. Journal of Evolutionary Economics, 17(2), 161-185. doi:10.1007/s00191-006-0046-0.

Valliere, D. (2010). Reconceptualising entrepreneurial framework conditions. International Entrepreneurship Management Journal, 6, 97112. DOI 10.1007/s11365-008-0077-0.

Van Stel, Storey, D., & Thurik, R. (2007). The effect of business regulations on Nascent and Young Business Entrepreneurship. Small Business Economics, 28, 171-186.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small Business Economics, 13(1), 27-56.

Wright, M., Robbie, K., & Ennew, C. (1997). Venture capitalists and serial entrepreneurs. Journal of Business Venturing, 12(3), 227-249. doi:10.1016/S0883-9026(96)06115-0.

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

CrossRef Cited-by

1. Esteban Lafuente, Yancy Vaillant. (2021). Pulling from the front or pushing from behind: how competency prioritisation should differ to optimise firm competitiveness. European Business Review, 33(6), p.849. https://doi.org/10.1108/EBR-11-2020-0288.

2. Radosław Wolniak, Bożena Skotnicka-Zasadzień. (2018). Developing a Model of Factors Influencing the Quality of Service for Disabled Customers in the Condition s of Sustainable Development, Illustrated by an Example of the Silesian Voivodeship Public Administration. Sustainability, 10(7), p.2171. https://doi.org/10.3390/su10072171.

3. Edgar Nave, Ricardo Gouveia Rodrigues. (2023). Economic development levels and ease of doing business: is there a relationship?. Review of International Business and Strategy, 33(3), p.371. https://doi.org/10.1108/RIBS-11-2021-0151.

4. Anderson Galvão, Carla Mascarenhas, Ricardo Gouveia Rodrigues, Carla Susana Marques, Carmem Teresa Leal. (2017). A quadruple helix model of entrepreneurship, innovation and stages of economic development. Review of International Business and Strategy, 27(2), p.261. https://doi.org/10.1108/RIBS-01-2017-0003.

5. Shyla Del-Aguila-Arcentales, Aldo Alvarez-Risco, Micaela Jaramillo-Arévalo, Myreya De-la-Cruz-Diaz, Maria de las Mercedes Anderson-Seminario. (2022). Influence of Social, Environmental and Economic Sustainable Development Goals (SDGs) over Continuation of Entrepreneurship and Competitiveness. Journal of Open Innovation: Technology, Market, and Complexity, 8(2), p.73. https://doi.org/10.3390/joitmc8020073.

6. Cecilia Rivas, Brendali Carrillo, Giannina Robinson. (2022). Competitividad de empresas turísticas en el Perú. Revista Venezolana de Gerencia, 27(Edición Especial 7), p.203. https://doi.org/10.52080/rvgluz.27.7.14.

7. Uttam Chakraborty, Santosh Kumar Biswal. (2023). Impact of social media participation on female entrepreneurs towards their digital entrepreneurship intention and psychological empowerment. Journal of Research in Marketing and Entrepreneurship, 25(3), p.374. https://doi.org/10.1108/JRME-03-2021-0028.

8. María Huertas González-Serrano, Ferran Calabuig Moreno, Josep Crespo Hervás. (2021). Sport management education through an entrepreneurial perspective: Analysing its impact on Spanish sports science students. The International Journal of Management Education, 19(1), p.100271. https://doi.org/10.1016/j.ijme.2018.11.007.

Dimensions

PlumX

Visitas a la página del resumen del artículo

Descargas

Licencia

Derechos de autor 2014 Innovar

Esta obra está bajo una licencia internacional Creative Commons Reconocimiento-NoComercial-CompartirIgual 3.0.

Todos los artículos publicados por Innovar se encuentran disponibles globalmente con acceso abierto y licenciados bajo los términos de Creative Commons Atribución-No_Comercial-Sin_Derivadas 4.0 Internacional (CC BY-NC-ND 4.0).

Una vez seleccionados los artículos para un número, y antes de iniciar la etapa de cuidado y producción editorial, los autores deben firmar una cesión de derechos patrimoniales de su obra. Innovar se ciñe a las normas colombianas en materia de derechos de autor.

El material de esta revista puede ser reproducido o citado con carácter académico, citando la fuente.

Esta obra está bajo una Licencia Creative Commons: